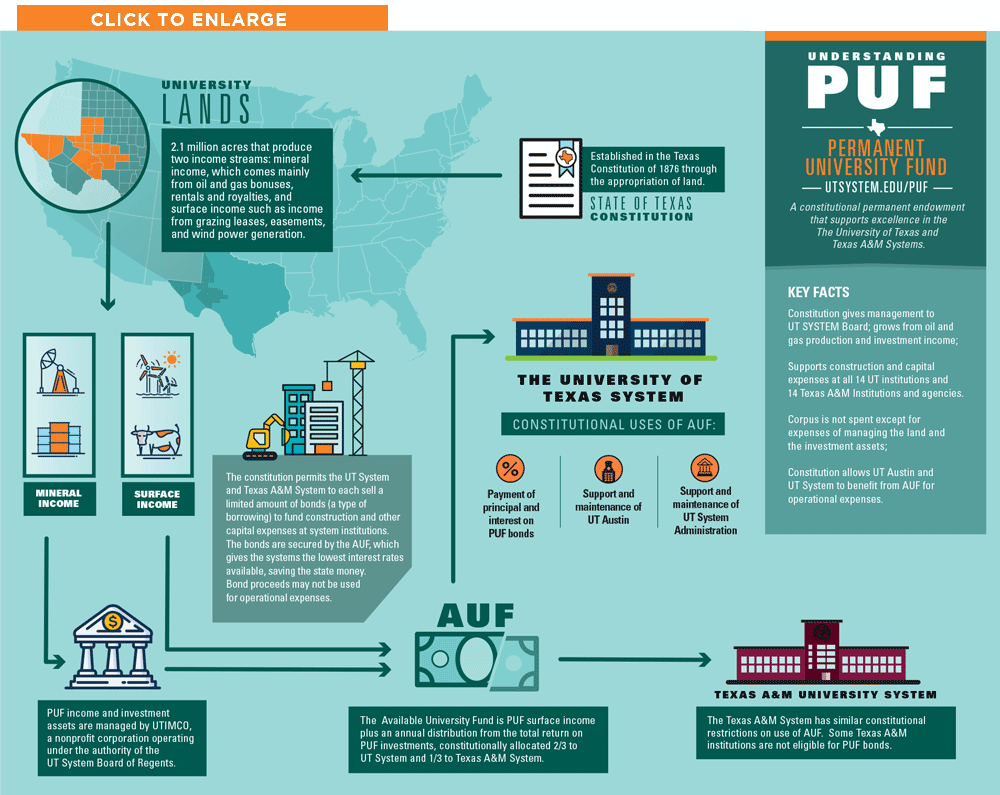

The Permanent University Fund (PUF) is one of our state’s most unique, important, and enduring competitive advantages. In 1876, the Texas Constitution set aside land in West Texas to support The University of Texas and Texas A&M systems of higher education. Today, that land – encompassing 2.1 million acres – is leased to oil and gas companies whose wells generate revenue that flows into the PUF. Land also is leased for grazing, wind farms and other revenue-generating activities.

Infographic also available to download as a PDF file.

Permanent University Fund (PUF) Quick Facts:

- The Texas constitution stipulates that The University of Texas system gets two-thirds of the benefits of the PUF and the Texas A&M system gets one-third.

- The PUF endowment is managed by The University of Texas/Texas A&M Investment Management Company (UTIMCO), under the authority of the UT System Board of Regents, and the land is managed by the University Lands office.

- The Constitution allows the UT System to issue bonds guaranteed by the AUF in an amount equal to 20% of the book value of the PUF.

- PUF bonds may be issued for the benefit of all UT System institutions, but may only be used to finance capital expenditures.

- The PUF also benefits the UT and A&M institutions through an annual distribution of revenue from PUF investment returns to the Available University Fund (AUF). The size of the distribution is usually five percent or less of the market value of PUF investments, and the distribution may not exceed seven percent.

- The Texas Constitution requires that AUF first be used to pay principal and interest on PUF bonds, but the remainder may be used to support and maintain UT Austin and UT System Administration. The Constitution does not allow AUF to be used for operational expenses for the other UT System institutions.